Evergrande is Chinas second-biggest. Evergrandes suppliers homeowners wealth product holders.

They have almost RMB 335 billion in debt due this year.

Evergrande debt holders. China debt crunch China Evergrande faces default test as bond coupons come due. Evergrande 6666-1130 is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated. Evergrande is the worlds most indebted property developer and has debt due that it cant pay.

The firm said its interest-bearing debt was at 570 billion yuan 882 billion at the end of June down from a peak of 8355 billion yuan a. Evergrandes dollar bond holders need only look at how investors in China have responded to the developers latest crisis. In addition to that debt Evergrande holds 74 billion in bonds that are due in 2022.

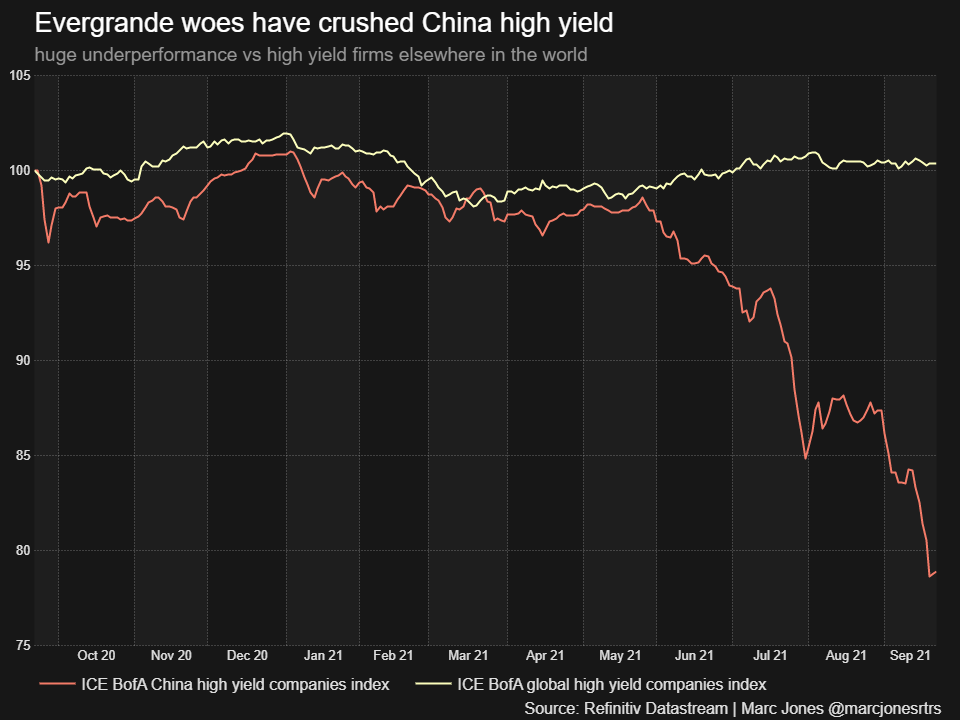

There are significant losses already for the international holders. Evergrande denies rumours of bankruptcy and reorganisation after weekend of protests at offices across China. 14473 million in payments in time to employees and other holders.

Ad Find Lady Dior Card Holder. Ad Find Lady Dior Card Holder. Is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are left to.

Search Faster Better Smarter Here. Ping An Insurance becomes top holder. There is a strong possibility that the Evergrande group is going to default on their debt.

These are bank loans and other borrowings which made up 81 of these debts. That same month Evergrande also kicked off a nationwide sales promotion offering a 30 per cent discount on all real estate properties in a bid to boost sales and meet its target of cutting debt. Chinas second largest Real Estate company Evergrande is over 305B in debt.

Evergrandes debt shrank to 5718 billion yuan S1192 billion as at June 30. Search Faster Better Smarter Here. At about 65 of total Chinese property sector debt.

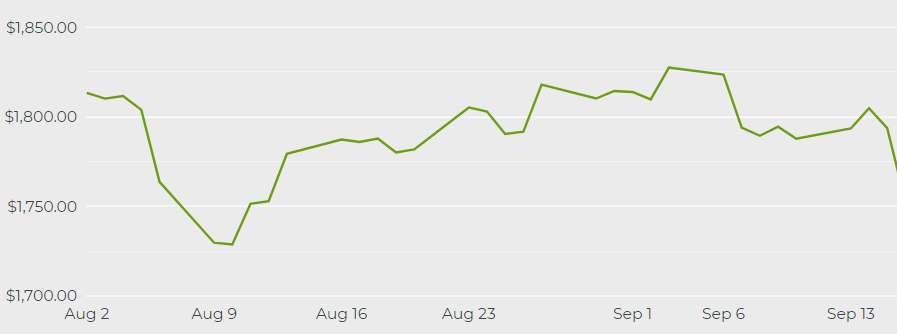

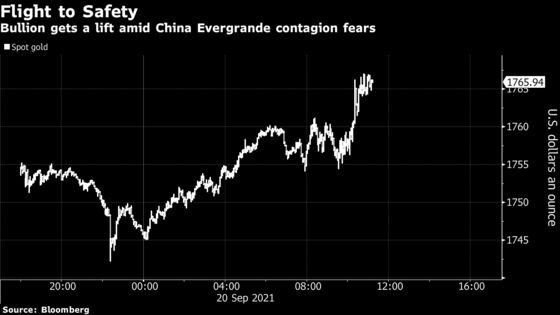

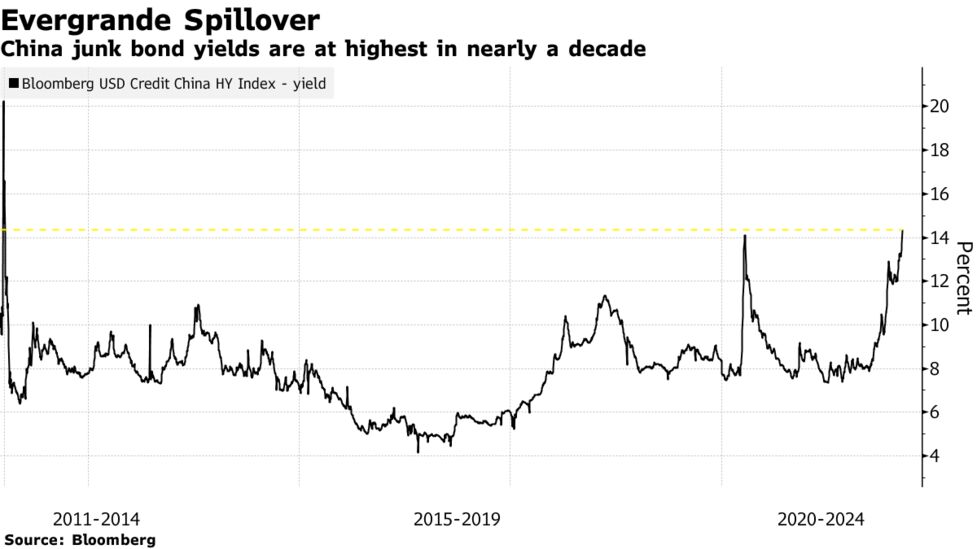

Meanwhile bondholders will likely lose 75 percent. Is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are left to. As the company struggles to repay creditors Global markets have responded with selloffs.

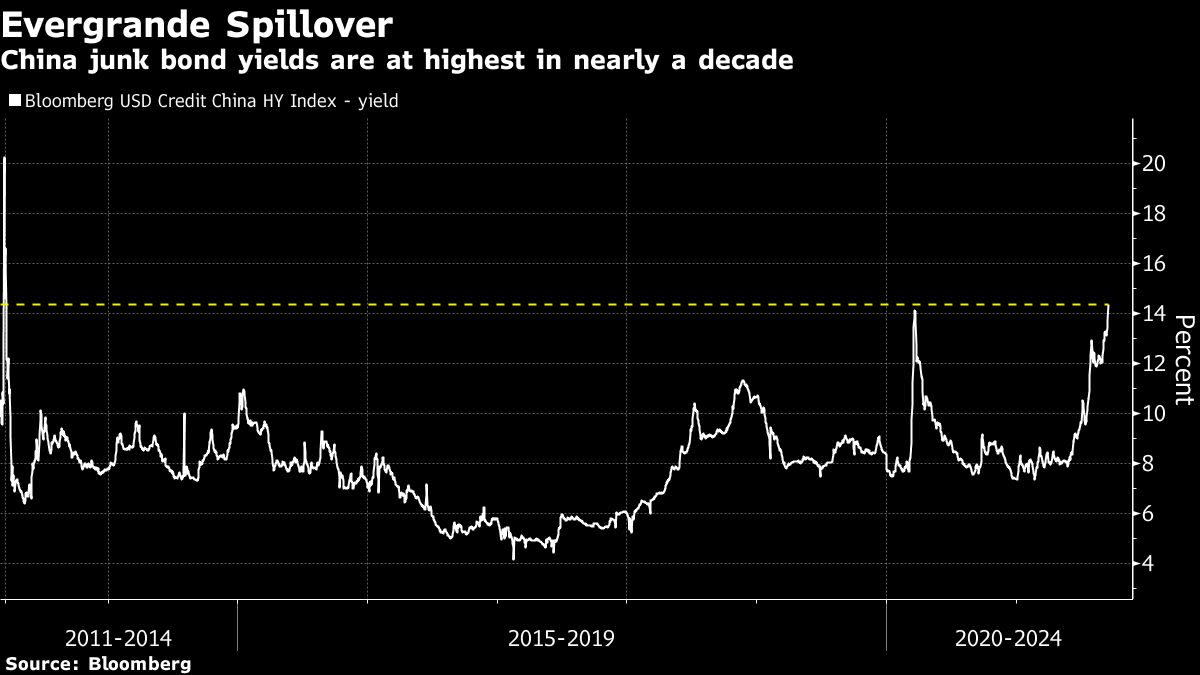

Rating agency Fitch has downgraded the Evergrande. China Evergrandes restructuring quasi unavoidable amid distress as free pass on debt binge ends. Questions loom about a government bailout and whether Evergrande.

To muscle out a decent recovery rate Evergrandes bond holders need to get tough and political just like investors in its wealth. While Chinas offshore CDS market is illiquid and rarely used holders of Evergrandes debt are global and not being able to hedge for the downside. The companys complex web of obligations to banks bond holders.

Evergrande How China Evergrande S Debt Troubles Pose A Systemic Risk Real Estate News Et Realestate

China Evergrande Faces Default Test As Bond Coupons Come Due Nikkei Asia