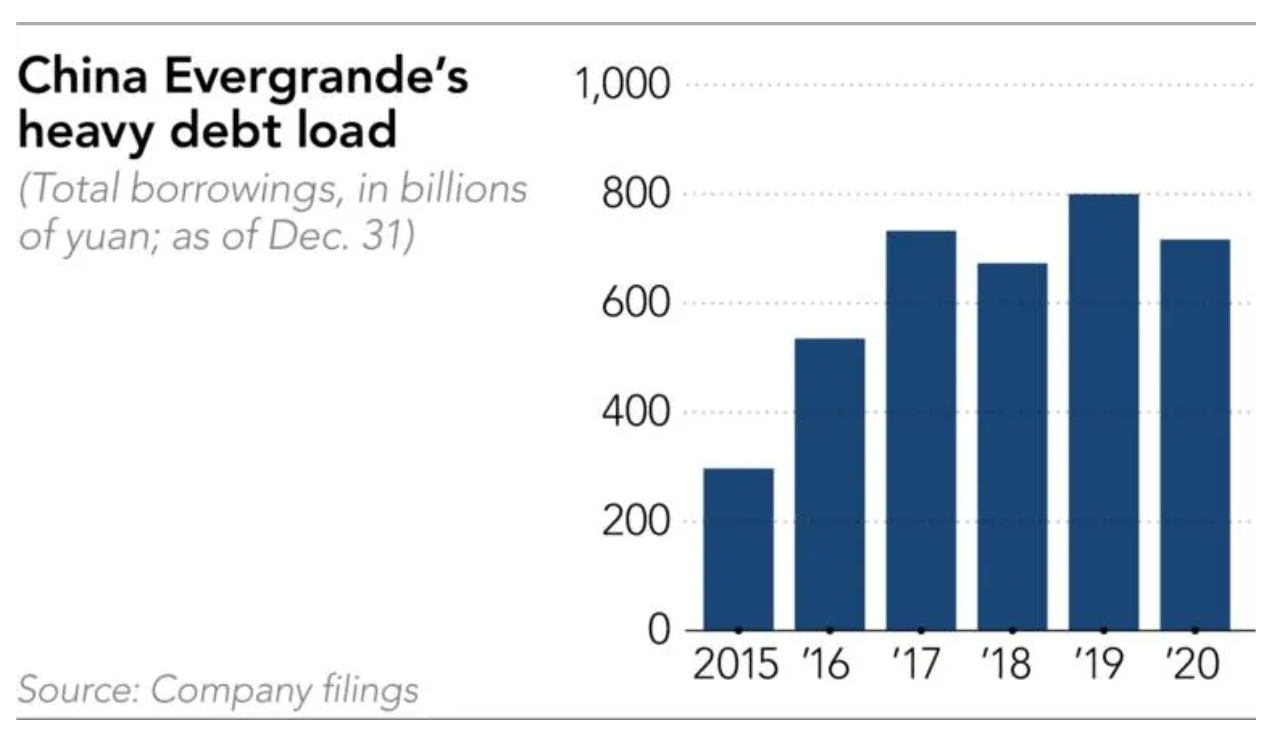

But over the past several years the authorities have shown greater willingness to let companies fail in order to rein in. A spillover of the crisis at China Evergrande Group into other parts of the economy could become a systemic problem.

BUT Evergrandes insolvency may be a sign of Chinas real estate.

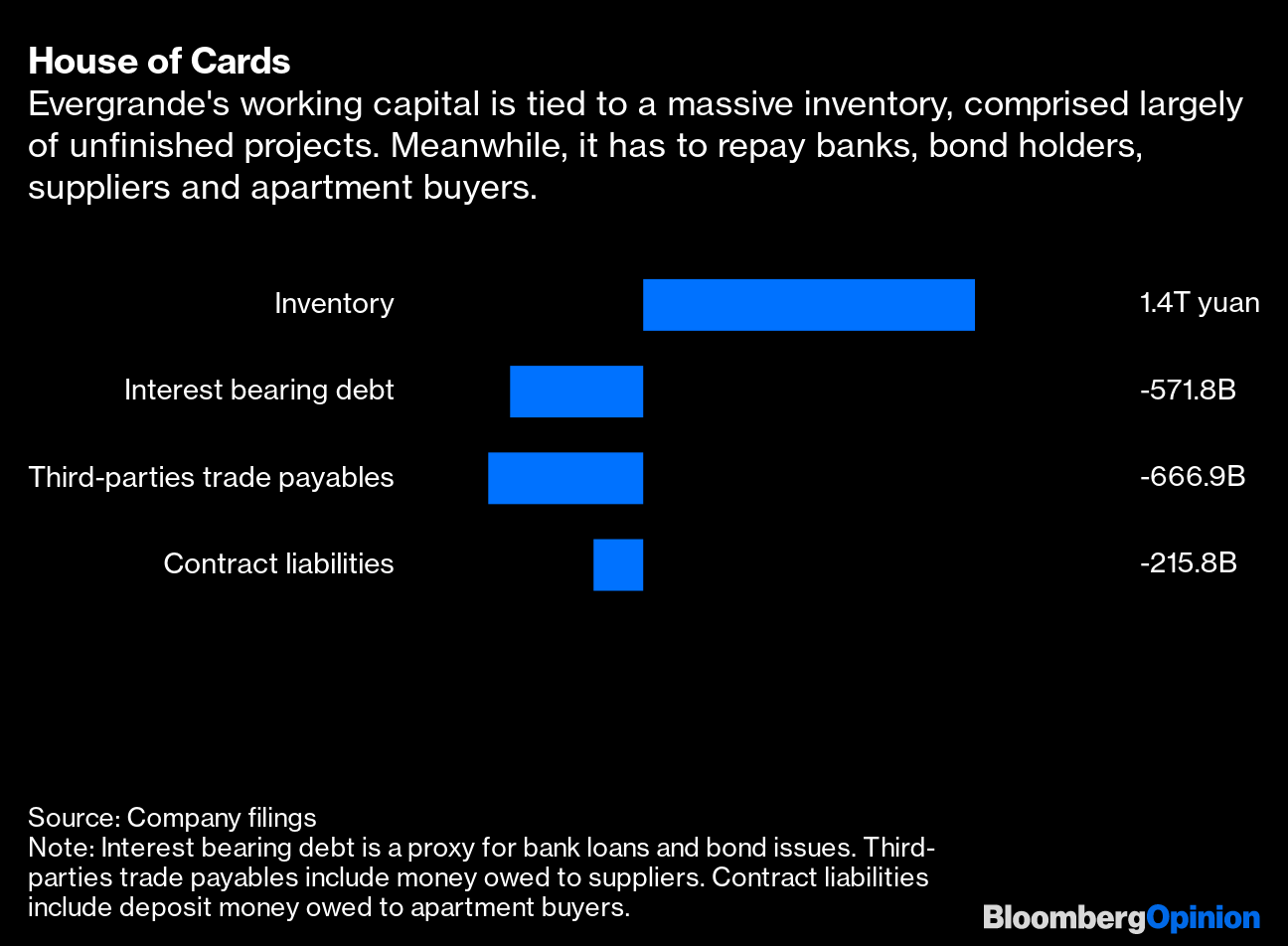

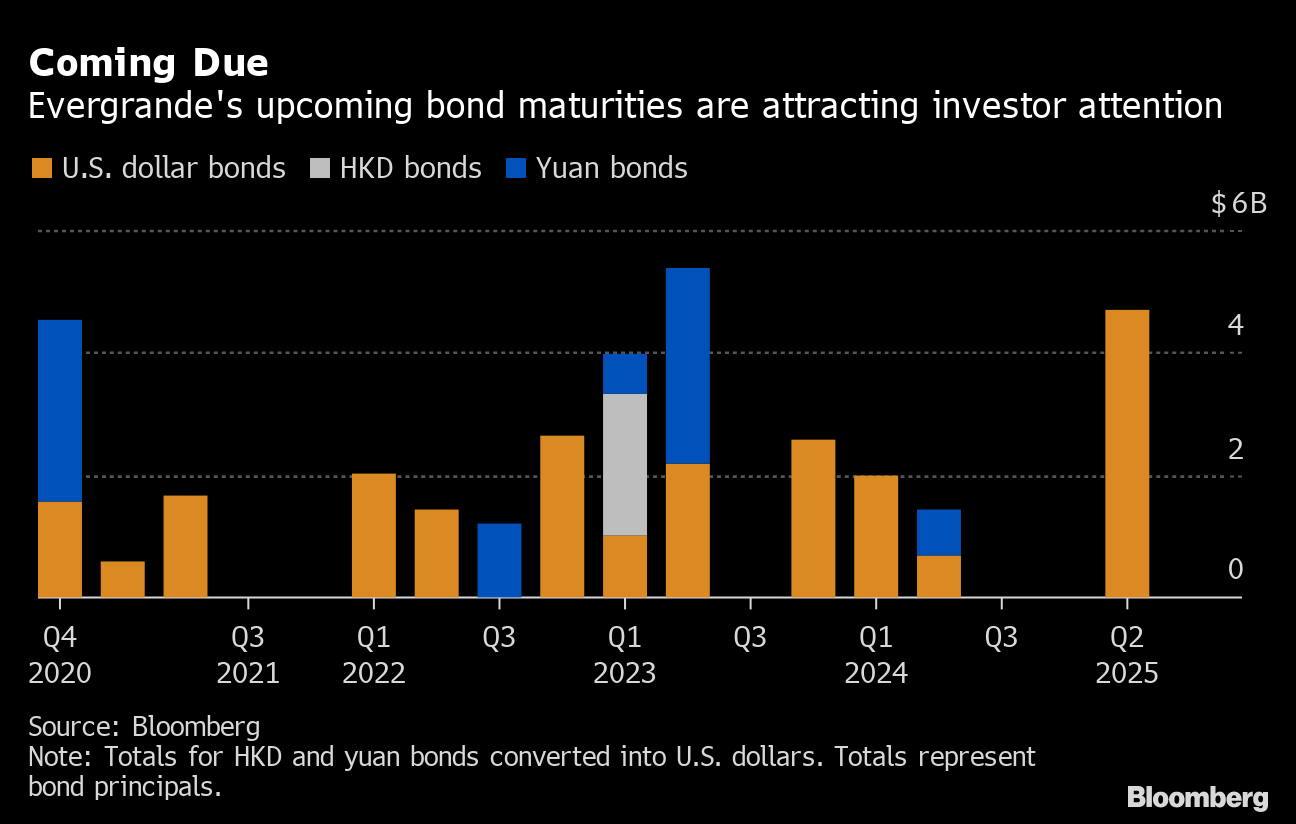

Evergrande debt problem. A campaign by the central bank to tame property debt and reduce the banking. China Evergrande Group has debt due next week that it cant pay but investors should pay attention. Evergrande faces more than 300 billion in debt hundreds of.

Evergrande is faced with more than 300 billion in debt hundreds of unfinished residential buildings and angry suppliers who have shut down. Get Instant Quality Results Now. The company has also begun.

Evergrande is faced with more than US300 billion S402 billion in debt hundreds of unfinished residential buildings and angry suppliers who have shut. Ad Find Debt Relief For. Ad Find Debt Relief For.

Ad Get Consolidation Debt Program. And for decades the investors have been right. Search Faster Better Smarter at ZapMeta Now.

Every once in a while a company grows so big and messy that. Evergrande Is a Symptom Not Cause of Chinas Debt Woes By Sara Hsu Due to structural flaws in Chinas financial system there will likely be. Evergrandes debt problems per se are not a serious problem for China.

How would Evergrandes failure affect Chinas economy. Get Instant Quality Results Now. Search Faster Better Smarter at ZapMeta Now.

Ad Get Consolidation Debt Program. China Evergrande Is a Big Problem for the Market. Evergrande faces over 300 billion in debt hundreds of unfinished homes and angry suppliers who have closed construction sites.

17 2021 854 am ET. Answer 1 of 3. Evergrande with its billions of dollars in debt may stand in the way.

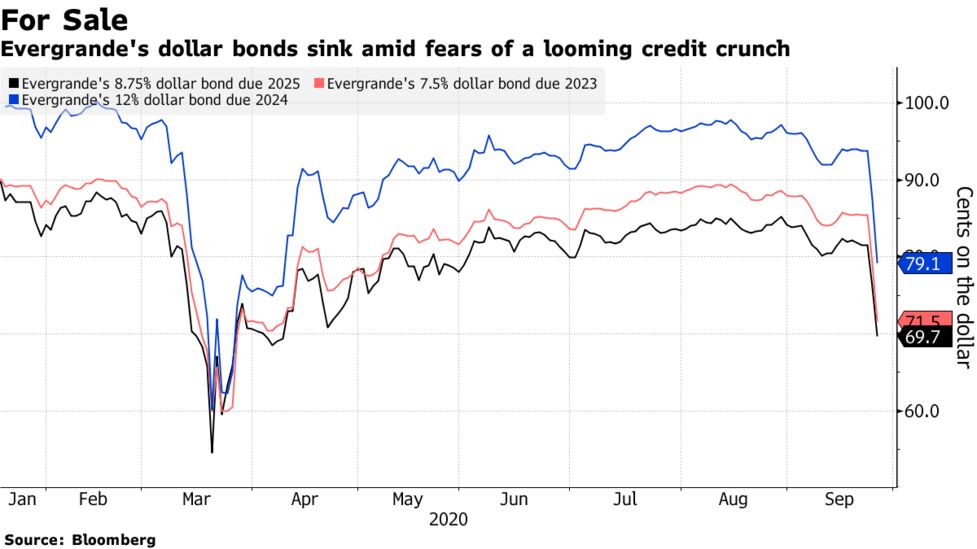

Regulators want to fix the property sectors bad habit of borrowing too much. Advisors should keep an eye on credit-default swaps to gauge the risk of broader market. Chinas property giant Evergrande the worlds most indebted property developer with more than 300 billion of liabilities has created fears of a.

A campaign by the central bank to tame property debt and reduce the banking. On Sep 10 2021. Evergrande is faced with more than 300 billion in debt hundreds of unfinished residential buildings and angry suppliers who have shut down.

How would Evergrandes failure affect Chinas economy. Why Evergrandes Debt Problems Threaten China. Another rating agency Moodys said Evergrande was out of money and time.

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

Economy Of China Threatened By Evergrande S Debt Problem Realty 24 Live

Why China S Economy Is Threatened By A Property Giant S Debt Problems The Japan Times

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

Evergrande Seeks Safe Descent From Usd 130 Billion Debt Mountain Krasia