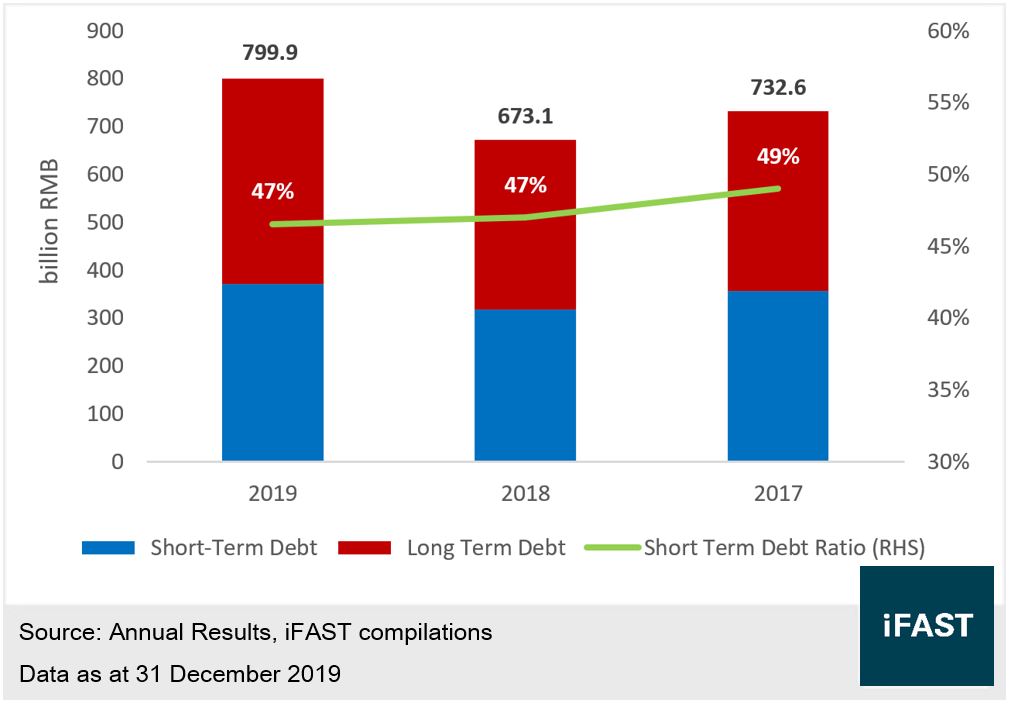

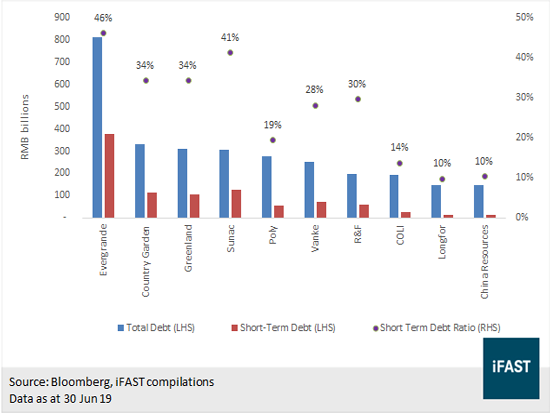

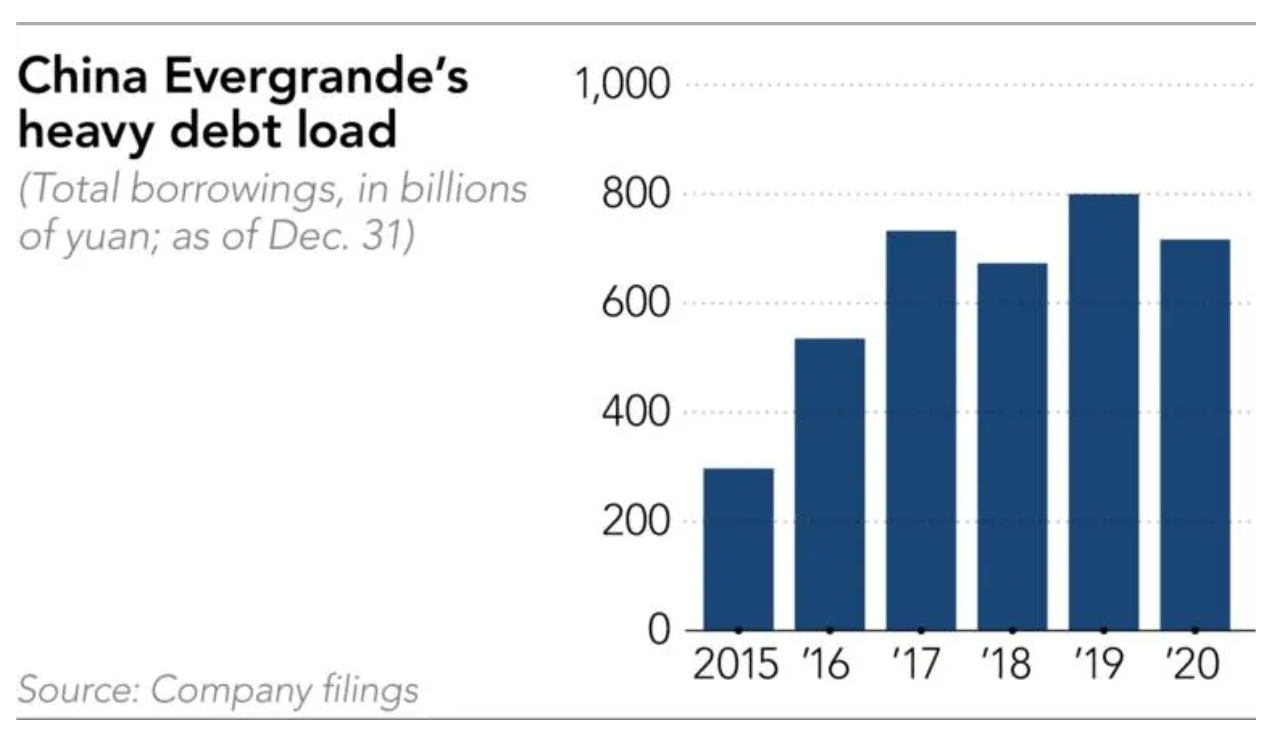

The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt. Chinas second largest Real Estate company Evergrande is over 305B in debt.

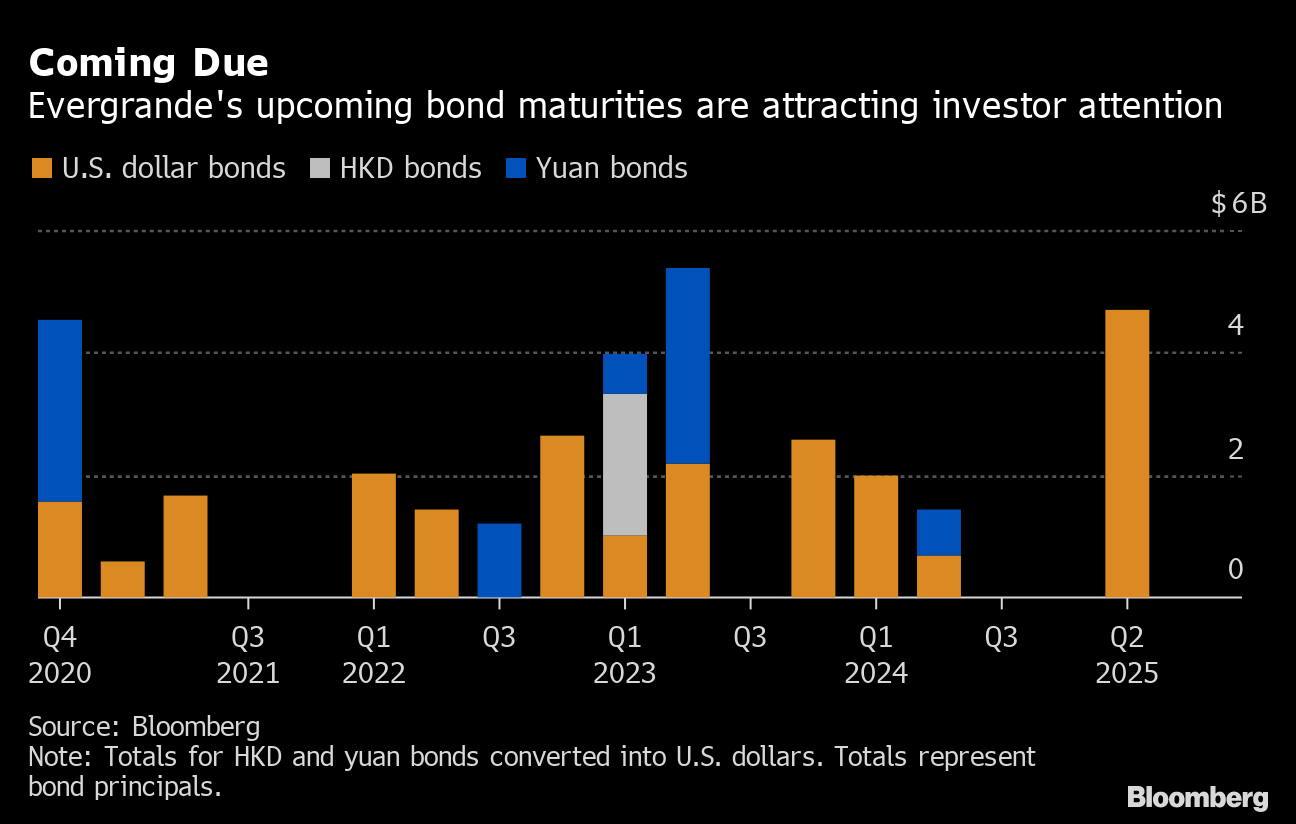

Evergrande Squeezed By 53 Billion Of Maturities In Tough Market

A high debt to equity ratio generally means that a company has.

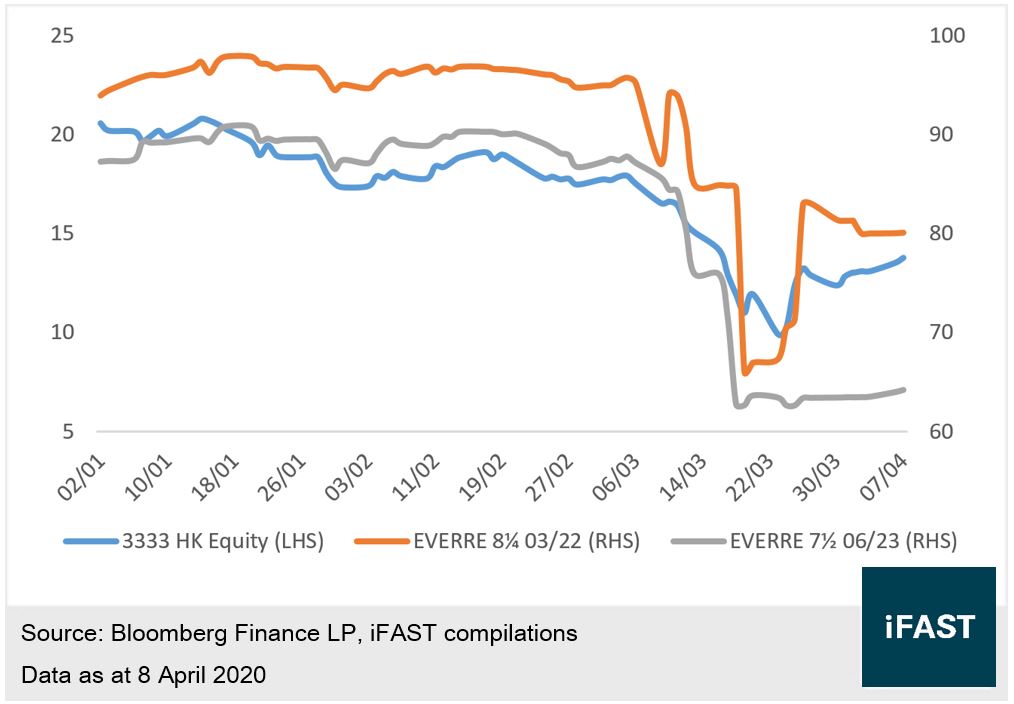

Evergrande debt ratio. As the company struggles to repay creditors Global markets have responded with selloffs. Questions loom about a government bailout and whether Evergrande. China Evergrande Groups debt to equity for the quarter that ended in Dec.

Chinas Evergrande debt crisis. 2020 was 490. Debt to Equity Ratio Definition.

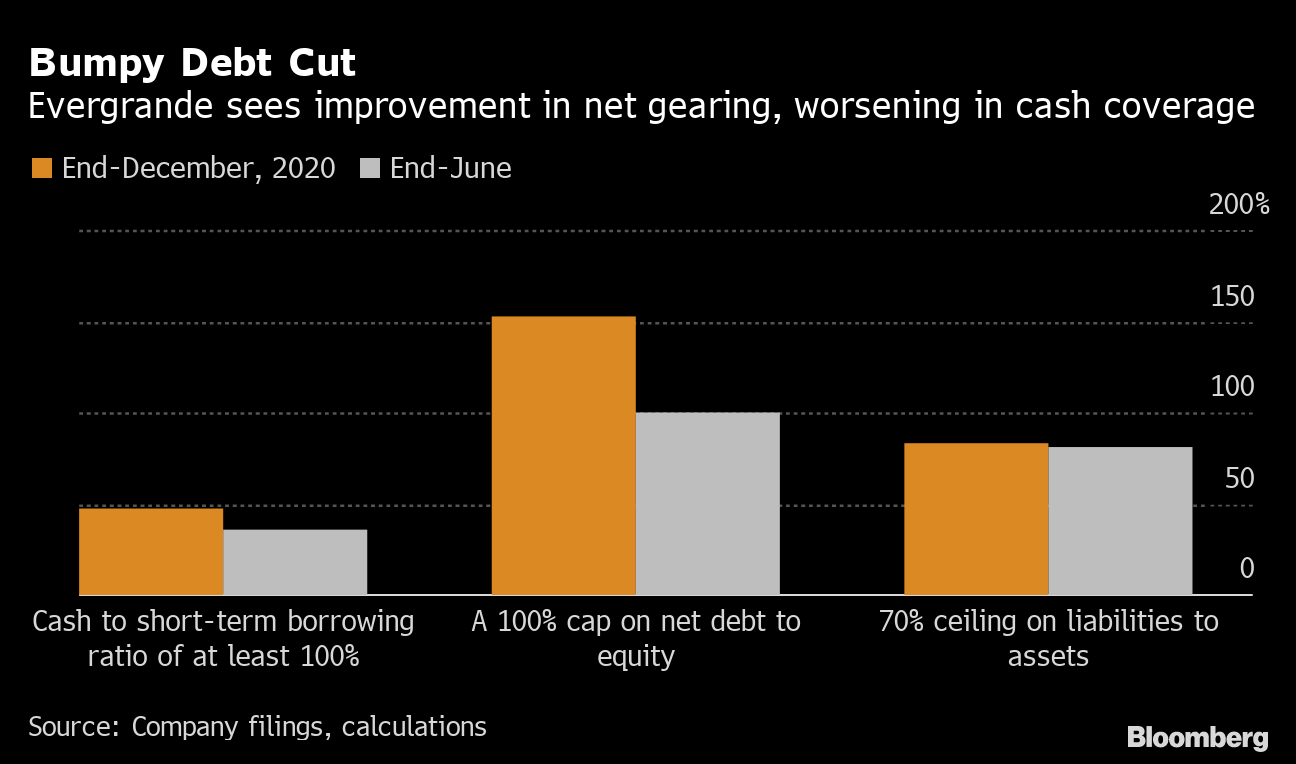

A net gearing ratio of less than 100 and a cash-to-short-term debt ratio of at least one.

Moody S Downgrades Evergrande Despite Debt Relief Progress Caixin Global

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

When Yields Cross 12 A Comprehensive Analysis On Evergrande Bondsupermart

Evergrande Entering The Era Of Deleveraging Bondsupermart

Evergrande Seeks Safe Descent From Usd 130 Billion Debt Mountain Krasia

Evergrande Profit Drops As Developer Seeks To Ease Cash Crunch